Shares in International Airlines Group (LSE: IAG) have rebounded sharply from their 2022 bottom price of 94p, and are now up 35% in less than a month. That being said, the IAG share price could see its growth momentum slow due to a number of headwinds.

Stalling recovery

IAG’s figures have shown a continued improvement in recovering travel demand. Passenger numbers saw healthy increases in the company’s latest Q3 update. Furthermore, its top and bottom lines saw monumental jumps. But more importantly, the group returned to profitability. As a result, the IAG share price has since increased by a further 6%.

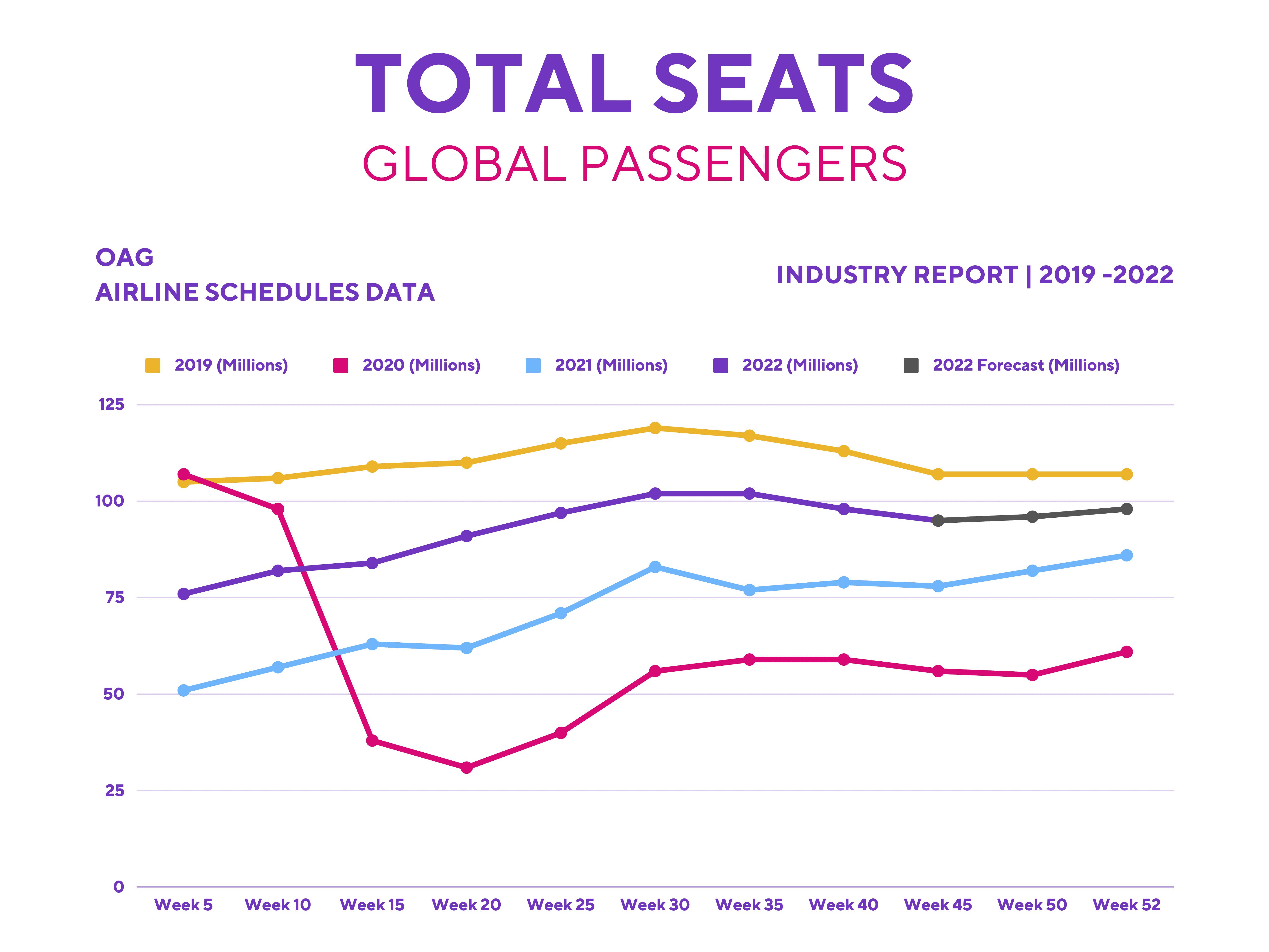

Having said that, overall air travel traffic still remains below its pre-pandemic levels. This is because, even though cross-Atlantic demand has seen robust strength, Asia and Pacific routes have been muted due to COVID restrictions. Additionally, demand for business travel is still suffering from a slower than expected rebound.

Fuelling higher costs

Aside from stalling passenger growth, however, there are also a number of additional headwinds that could prevent the IAG share price from climbing higher. For one, the price of oil has increased in recent weeks. This comes on the back of China contemplating its zero-COVID policy, which could spark heightened demand for the black gold.

The FTSE 100 company is decently hedged in fuel for the rest of the year, at 68%. Nonetheless, it remains vulnerable going into 2023. IAG only has approximately 47% of its fuel costs hedged thus far. This could present a substantial negative impact to its improving bottom line.

Apart from that, staff at Heathrow Airport are going on strike in late November. This isn’t helped either by a potential return of passenger caps due to a lack of staff. As a consequence, British Airways would have to cancel a number of flights, which would impact its recovery.

Maximum altitude?

So, has the IAG share price hit a ceiling then? Well, travel demand is expected to remain sturdy going into the holiday season. As such, CEO Luis Gallego expects passenger capacity to hit 95% of 2019 levels by Q1. Moreover, airlines have cited continued and strong travel demand which shows no signs of waning, or at least just yet.

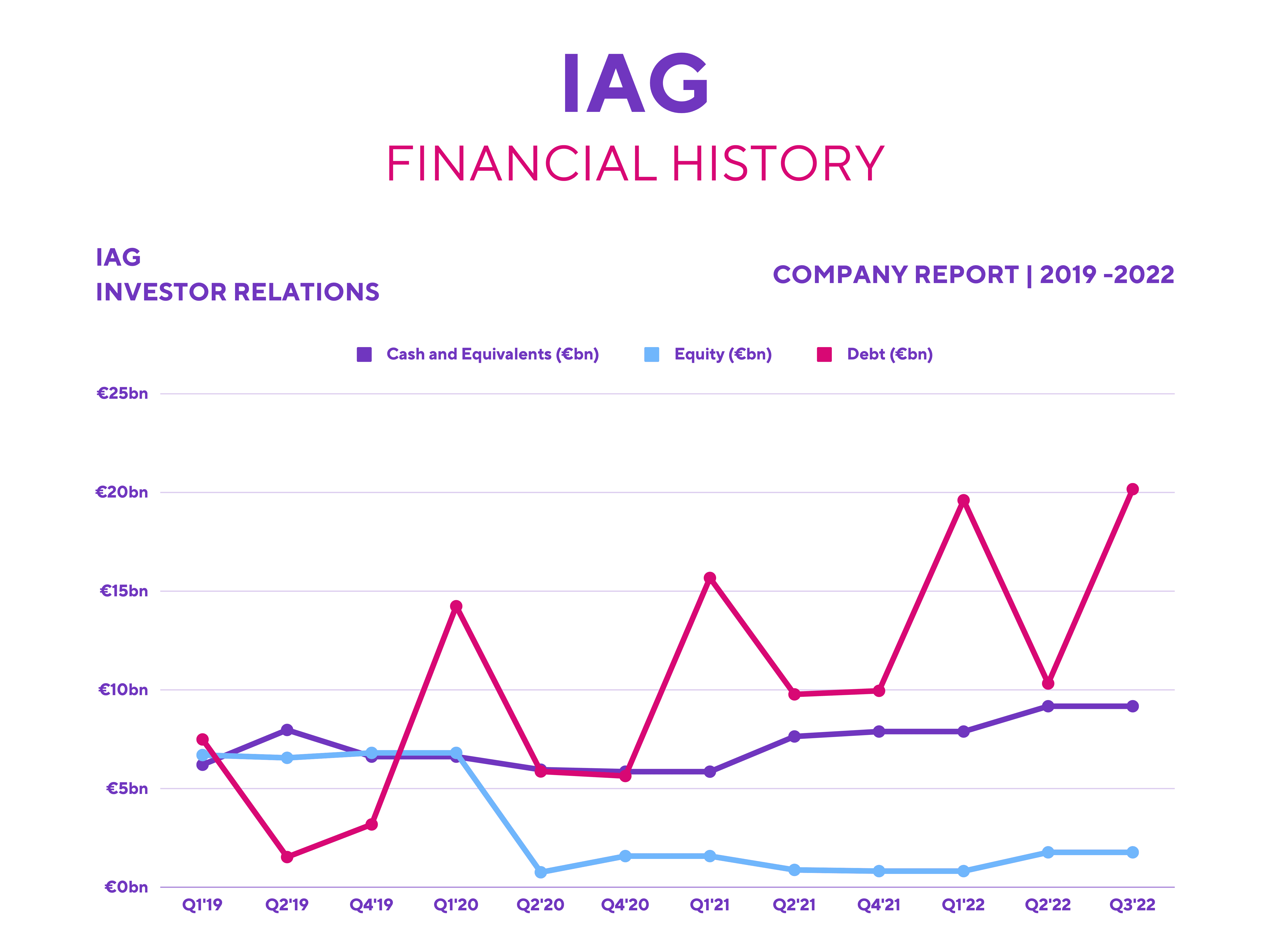

Nonetheless, an impending recession, higher energy and labour costs, as well as contracting economic data present a number of obstacles. This doesn’t bode well for the airline, especially when its balance sheet still requires some improvement. Even though the firm has returned to profitability, it still has an eye-watering amount of debt to pay off. Excluding seasonal debt from forward bookings, its debt-to-equity ratio still remains above desirable levels.

With all that in mind, I think the IAG share price still has some potential to grow. However, its upside potential remains restricted for the medium term due to worsening macroeconomic conditions. This is presumably why a number of brokers from Deutsche, JP Morgan, and Berenberg still rate the stock a ‘hold’. Therefore, I’ll be putting IAG on my watchlist for the time being and may invest when its financials improve.